Completion day is without doubt the best part of the entire home buying process. It’s on this day that you’ll pick up the keys and take possession of your new home in Nuneaton. But before completion day can happen, there are a few final checks to be done.

What Happens Before Completion?

Prior to completion your solicitor will ensure that all of the mortgage conditions have been met and request the money from the lender.

The lender will also carry out some last minute checks to ensure there have been no significant changes to your credit rating. So, if you take out a loan to buy a new car for example, this could have very negative implications on your mortgage offer.

On the other side, the seller’s solicitor will request a redemption certificate that’s calculated to the day of completion if the seller still has a mortgage on the property.

Essentially this is a document that details what will happen to the outstanding balance on the mortgage when you take possession. In most cases, the seller will pay off the outstanding balance from the proceeds of the sale, while you will have a brand new mortgage agreement in place.

What Happens on Completion Day?

The solicitors on both sides will carry out their final checks and paperwork, including a completion statement which sets out all of the payments made and received.

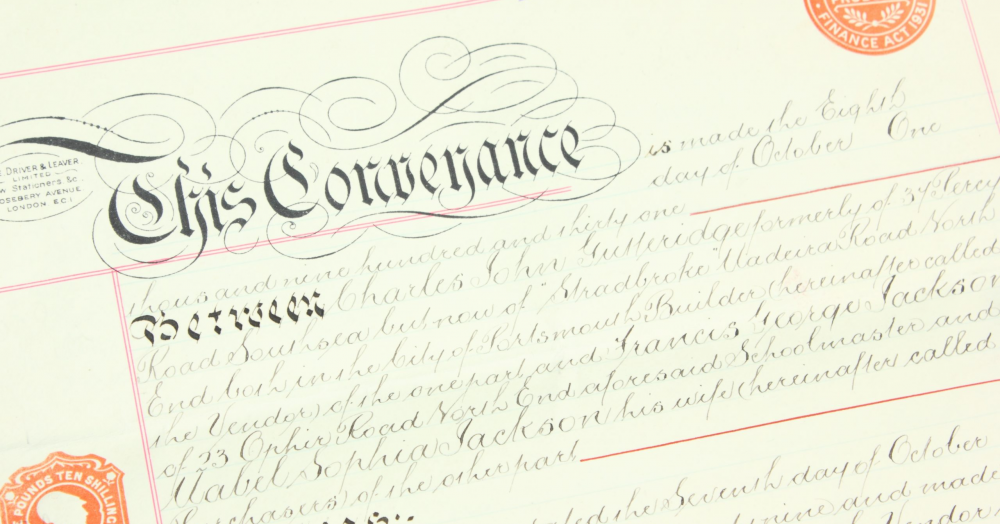

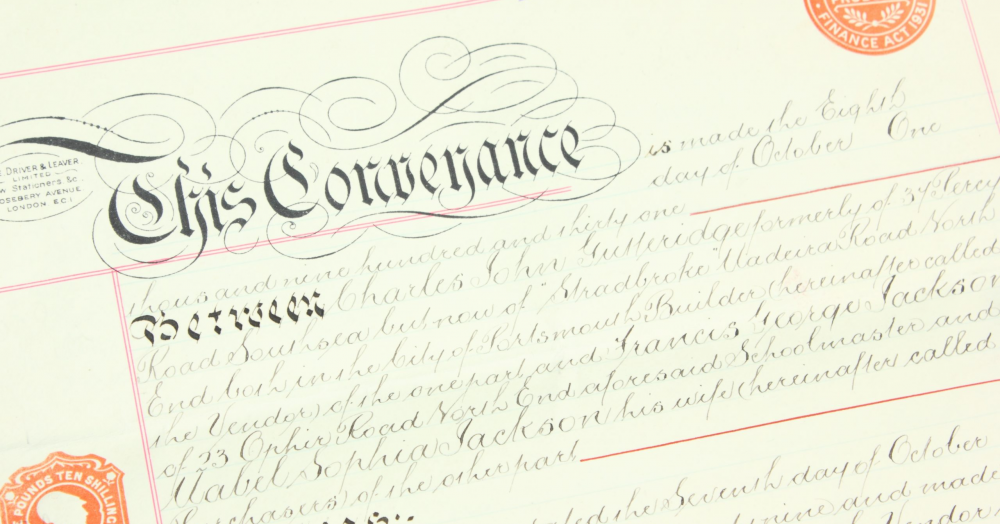

Any outstanding invoices will be raised too, including the estate agent fees for the seller and any conveyancing costs that you haven’t paid yet. These will be due on completion.

Once the final checks have been completed and signed off, your solicitor will transfer the money to the seller’s solicitor.

When they’ve confirmed receipt of the funds, they will let the estate agent know that the keys are ready to be collected and you will be notified by their solicitor that they’re now able to go and collect them.

How to Ensure a Smooth Completion Day

While completion day is an exciting day for both parties and the final point in a lengthy process, it can also be quite stressful too.

To ensure it runs as smoothly as possible, there are a few things that you and the seller can do.

For sellers, it’s vital to have everything boxed up and ready to move out prior to the day. The target time to move out is usually between 12pm and 2pm, although it can vary depending on the number of buyers and sellers in the chain.

Put simply though, things will run a lot smoother if the sellers have everything ready to go first thing in the morning, rather than scrambling to pack everything by lunchtime.

As for the buyer, all that’s really required is to have your phone to hand and be ready to pick up the keys from the estate agent! If you’re having to vacate your old property on the same day, then they’ll also need to be packed up and ready to move.

There’s no requirement for you to actually move into your new property on completion day, however, it’s usual to do so unless you are a first-time buyer who still lives at home with parents, as you can simply collect the keys on completion day and then move in when you want to, perhaps after you’ve decorated for example.

How Much Time is There Between Exchange and Completion?

The completion day is agreed between you and the seller in advance, and it usually takes place 7 to 14 days after the exchange of contracts.

In some cases it can take less than 7 days, and it’s even possible to exchange and complete on the same day, but this is less preferable as it can be more stressful for all concerned.

What is the Best Day to Complete?

Most people choose to complete on a Friday, as it then gives them the weekend to unpack and get things in place.

However, due to the demand for this day, it can mean that removal costs are higher, and solicitors are busier, as they may have several completions to work through on the same day.

Therefore, it’s usually better to complete earlier in the week if possible, as it can save you money and your solicitor or conveyancer should be slightly less busy.

Alan Cooper Estates are your local property experts for the Nuneaton area. Call us on 024 7634 9336 or email sales@alan-cooper.co.uk to chat with a member of our friendly and experienced team.